90%

Reduction in monthly billing time.3x

Faster quote-to-cash cycle by unifying quoting and billing.15%

Uplift in revenue capture from fully accurate invoicing.Schedule your demo and get started in hours.

Sequence does exactly what Stripe couldn’t. It handles our dynamic platform fees, custom discounts, and usage billing out of the box. We’ve eliminated manual invoicing and reduced the risk of undercharging, which has had a direct impact on our ability to capture revenue accurately as we scale.

Chaitanya Sarda, CEO / Co-Founder @ AiPrise

AiPrise provides AI native KYB and AML infrastructure that powers onboarding and compliance for fintechs and global marketplaces.

After quickly scaling from 20 to over 100 customers in a few months, the manual Stripe billing process became a bottleneck for Chaitanya and the AiPrise team as they hacked together a Python script to model their dynamic pricing, platform fees, and usage-based charges.

Since switching to Sequence, AiPrise automated 100 percent of invoicing, reduced the quote-to-cash cycle 3x by unifying quoting (sales) and billing (finance) onto a single platform, and saw a 15 percent uplift in revenue capture through fully accurate billing.

The Challenge

Scale beyond Stripe Billing’s limitations

Stripe couldn’t handle AiPrise’s dynamic monthly platform fees, per-customer pricing, or multi-phase discounts, forcing them to rely on a custom Python script to calculate invoices manually.

Eliminate manual quoting and contract misalignment

Quotes were created in Google Docs with no link to billing, increasing the risk of incorrect pricing, missed discounts, and duplicated data entry across sales and finance.

Automate usage-based invoicing as customer volume grows

AiPrise needed a reliable way to push usage data via API and generate accurate invoices without involving engineers in every billing cycle.

“We started with 20 customers and I could manage billing manually—now with over 100, it’s getting out of hand. Stripe can’t support our pricing model, so I’ve been running a huge Python script every month just to generate invoices.”

Chaitanya Sarda (Founder & CEO)

The Solution

Automate complex billing logic without custom scripts

Sequence allows AiPrise to set unique platform fees for each customer, apply monthly minimums, and configure multi-phase discounts directly in the UI. These billing rules are stored at the contract level and used to automatically generate accurate invoices each month.

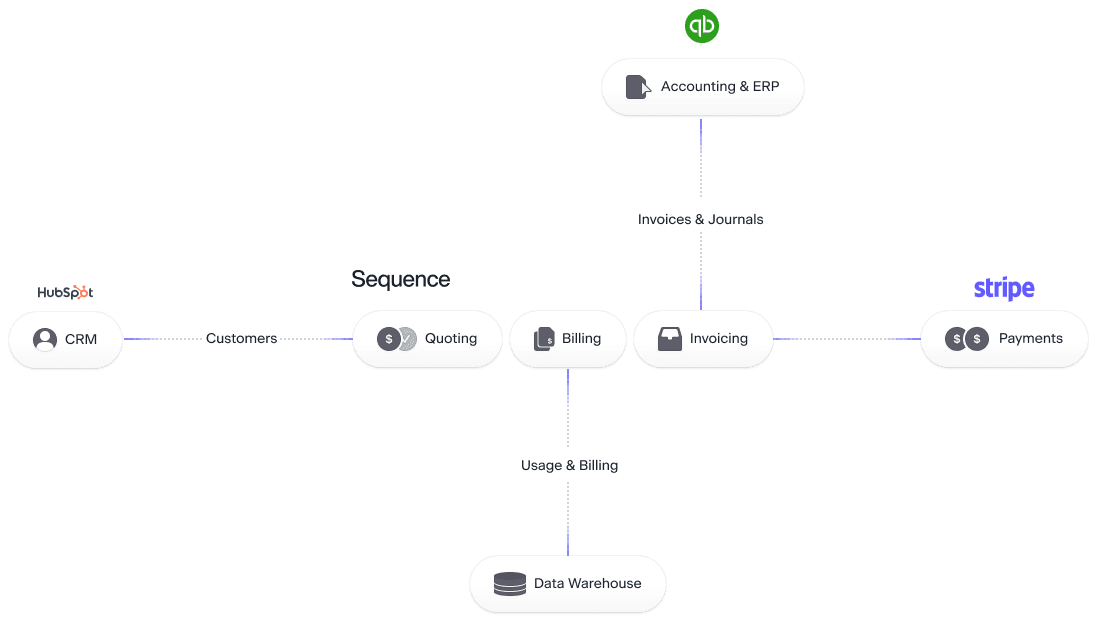

Unifies quoting and billing in a single workflow

Sales teams can generate quotes in Sequence, capture e-signatures, and convert them directly into billing schedules. This eliminates manual handoffs and ensures contract terms flow seamlessly into invoicing.

Scales usage-based invoicing with real-time API ingestion

AiPrise can send usage data to Sequence via API, with each event linked to the correct customer and product. Invoices are automatically updated based on real usage, reducing manual work and billing delays.

“With Sequence running our usage-based billing process, I feel much more confident in our ability to scale accurate revenue workflows for our sales and finance teams. We’ve successfully moved away from our custom python script, spend fewer eng resources on billing and have a much more scalable revenue collection foundation to grow from.”

Chaitanya Sarda (Founder & CEO)

Get in touch to book a Sequence demo.

Tech Stack Overview

Sequence Customers

Other companies using Sequence

See how forward-thinking companies use Sequence to reach their business goals.

See all customer stories